★ Pass on Your First TRY ★ 100% Money Back Guarantee ★ Realistic Practice Exam Questions

Free Instant Download NEW AHM-520 Exam Dumps (PDF & VCE):

Available on:

https://www.certleader.com/AHM-520-dumps.html

Want to know Exambible AHM-520 Exam practice test features? Want to lear more about AHIP Health Plan Finance and Risk Management certification experience? Study Downloadable AHIP AHM-520 answers to Up to the immediate present AHM-520 questions at Exambible. Gat a success with an absolute guarantee to pass AHIP AHM-520 (Health Plan Finance and Risk Management) test on your first attempt.

Free demo questions for AHIP AHM-520 Exam Dumps Below:

NEW QUESTION 1

With regard to the Medicaid program in the United States, it can correctly be stated that

- A. The federal government provides none of the funding for state Medicaid programs

- B. Federal Medicaid law is different from Medicare law in that the federal government explicitly sets forth the methodology for payment of Medicaid-contracting plans but not Medicare-contracting plans

- C. A state's payment to health plans for providing Medicaid services cannot be more than it would have cost the state to provide the services under Medicaid fee-for-service (FFS)

- D. States are prohibited from carving out specific services from the capitation rate that health plans receive for providing Medicaid services

Answer: C

NEW QUESTION 2

Providing services under Medicare or Medicaid can impose on health plans financial risks and costs that are greater than those related to providing services to the commercial population. Reasons that an health plan's financial risks and costs for providing services to Medicare and Medicaid enrollees tend to be higher include

- A. Most Medicare and Medicaid enrollees can disenroll from a health plan on a monthly basis

- B. The high incidences of chronic illness in both the Medicare and Medicaid populations results in higher costs related to coordinating care and case management

- C. Medicare and Medicaid enrollees tend to have a high level of costs in the first few months of enrollment as the health plan educates them about the health plan system and performs initial health screening to evaluate their health

- D. all of the above

Answer: D

NEW QUESTION 3

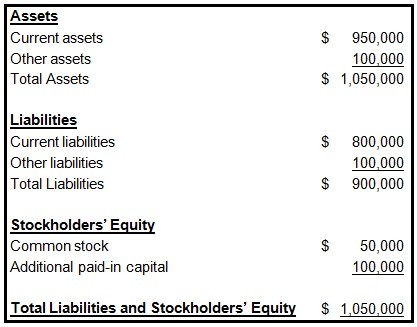

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

- A. Cash by its reported claims only

- B. Cash by its reported claims and its incurred but not reported claims (IBNR)

- C. Reported claims by its cash

- D. Reported claims and its incurred but not reported claims (IBNR) by its cash

Answer: B

NEW QUESTION 4

The Danube Health Plan's planning activities include tactical planning, which is primarily concerned with

- A. Establishing standards of performance for Danube's cost centers

- B. Forecasting Danube's premium income

- C. Planning for the short-term, day-to-day activities of Danube

- D. Identifying the markets in which Danube should concentrate its marketing efforts

Answer: C

NEW QUESTION 5

In order to calculate a simple monthly capitation payment, the Argyle Health Plan used the following information:

✑ The average number of office visits each member makes in a year is two

✑ The FFS rate per office visit is $55

✑ The member copayment is $5 per office visit

✑ The reimbursement period is one month

Given this information, Argyle would correctly calculate that the per member per month (PMPM) capitation rate should be

- A. $4.17

- B. $8.33

- C. $9.17

- D. $10.00

Answer: B

NEW QUESTION 6

The Montvale Health Plan purchased a piece of real estate 20 years ago for $40,000. It recently sold the real estate for $80,000 and reported a capital gain of $40,000 on this sale. Even though the purchasing power of the dollar declined by half during this period and Montvale realized no actual gain in purchasing power, Montvale recorded in its accounting records the $40,000 gain from this sale. This situation best illustrates the accounting concept known as the:

- A. Measuring-unit concept

- B. Time-period concept

- C. Full-disclosure concept

- D. Concept of periodicity

Answer: A

NEW QUESTION 7

All publicly traded health plans in the United States are required to prepare financial statements for use by their external users in accordance with generally accepted accounting principles (GAAP). In addition, health insurers and health plans that fall under the jurisdiction of state insurance departments are required by law to prepare certain financial statements in accordance with statutory accounting practices (SAP). In a comparison of GAAP to SAP, it is correct to say that:

- A. GAAP is established and promoted by the National Association of Insurance Commissioners (NAIC), whereas SAP is established and promoted by the Financial Accounting Standards Board (FASB)

- B. The going-concern concept is an underlying premise of GAAP, whereas SAP tends to focus on the liquidation value of the MCO or the insurer

- C. GAAP provides for a single method of valuing all of a health plan’s assets, whereas SAP offers the health plan more than one method for valuing its assets

- D. The principle of conservatism is fundamental to GAAP, whereas SAP generally is not conservative in nature

Answer: B

NEW QUESTION 8

The Proform Health Plan uses agents to market its small group business. Proform capitalizes the commission expense relating to this line of business by spreading the commissions over thepremium-paying period of the healthcare coverage. This approach to expense recognition is known as:

- A. Systematic and rational allocation

- B. Matching principle

- C. Immediate recognition

- D. Associating cause and effect

Answer: D

NEW QUESTION 9

The Longview Hospital contracted with the Carlyle Health Plan to provide inpatient services to Carlyle’s enrolled members. Carlyle provides Longview with a type of stop-loss coverage that protects, on a claims incurred and paid basis, against losses arising from significantly higher than anticipated utilization rates among Carlyle’s covered population. The stop-loss coverage specifies an attachment point of 130% of Longview’s projected $2,000,000 costs of treating Carlyle plan members and requires Longview to pay 15% of any costs above the attachment point. In a given plan year, Longview incurred covered costs totaling $3,000,000.

Carlyle most likely is responsible for paying Longview for the claims incurred before Longview has actually paid the medical expenses.

- A. True

- B. False

Answer: B

NEW QUESTION 10

In a comparison of small employer-employee groups to large employer-employee groups, it is correct to say that small employer-employee groups tend to:

- A. More closely follow actuarial predictions with respect to morbidity rates

- B. Generate more administrative expenses as a percentage of the total premium amount the group pays

- C. Have less frequent and smaller claims fluctuations

- D. Expose an health plan to a lower risk of anti selection

Answer: B

NEW QUESTION 11

The Eclipse Health Plan is a not-for-profit health plan that qualifies under the Internal Revenue Code for tax-exempt status. This information indicates that Eclipse

- A. Has only one potential source of funding: borrowing money

- B. Does not pay federal, state, or local taxes on its earnings

- C. Must distribute its earnings to its owners-investors for their personal gain

- D. Is a privately held corporation

Answer: B

NEW QUESTION 12

The Essential Health Plan markets a product for which it assumed total expenses to equal 92% of premiums. Actual data relating to this product indicate that expenses equal 89% of premiums. This information indicates that the expense margin for this product has:

- A. a 3% favorable deviation

- B. a 3% adverse deviation

- C. an 11% favorable deviation

- D. an 11% adverse deviation

Answer: A

NEW QUESTION 13

A health plan can use segment margins to evaluate the profitability of its profit centers. One characteristic of a segment margin is that this margin

- A. Is the portion of the contribution margin that remains after a segment has covered its direct fixed costs

- B. Incorporates only the costs attributable to a segment, but it does not incorporate revenues

- C. Considers only a segment's costs that fluctuate in direct proportion to changes in thesegment's level of operating activity

- D. Evaluates the profit center's effective use of assets employed to earn a profit

Answer: A

NEW QUESTION 14

The provider contract that Dr. Timothy Meyer, a pediatrician, has with the Cardigan health plan states that Cardigan will compensate him under a capitation arrangement. However, the contract also includes a typical low enrollment guarantee provision. Statements that can correctly be made about this arrangement include that the low enrollment guarantee provision most likely:

- A. Causes D

- B. Meyer's capitation contract with Cardigan to transfer more risk to him than the contract otherwise would transfer

- C. Specifies that Cardigan will pay D

- D. Meyer under an arrangement other than capitation until a specified number of children covered by the plan use him as their PCP

- E. Both A and B

- F. A only

- G. B only

- H. Neither A nor B

Answer: C

NEW QUESTION 15

Because a health plan cannot decline coverage for individuals who are eligible for conversion of group health coverage to individual health coverage, the bulk of the health plan's underwriting for conversion policies is accomplished through health plan design.

- A. True

- B. False

Answer: A

NEW QUESTION 16

The reimbursement arrangement that Dr. Caroline Monroe has with the Exmoor Health Plan includes a typical withhold arrangement. One true statement about this withhold arrangement is that, for a given financial period,

- A. D

- B. Monroe and Exmoor are equally responsible for making up the difference if cost overruns exceed the amount of money withheld

- C. Exmoor most likely distributes to D

- D. Monroe the entire amount withheld from her if her costs are below the amount budgeted for the period

- E. Exmoor pays D

- F. Monroe at the end of the period an amount over and above her usual reimbursement, and this amount is based on the performance of the plan as a whole

- G. Exmoor most likely withholds between 3% and 5% of D

- H. Monroe's total reimbursement

Answer: B

NEW QUESTION 17

One true statement about a type of capitation known as a percent-of-premium arrangement is that this arrangement

- A. Is the most common type of capitation

- B. Is less attractive to providers when the arrangement sets provisions to limit risk

- C. Sets provider reimbursement at a specific dollar amount per plan member

- D. Transfers some of the risk associated with underwriting and rating from a health plan to a provider

Answer: D

NEW QUESTION 18

Geena Falk is eligible for both Medicare and Medicaid coverage. If Ms. Falk incurs a covered expense, then:

- A. Medicaid will be M

- B. Falk’s primary insurer

- C. Medicare will be M

- D. Falk’s primary insurer

- E. Either Medicare or Medicaid will be M

- F. Falk’s primary insurer depending on her election

- G. Medicare and Medicaid will each be responsible for one-half of M

- H. Falk’s covered expense

Answer: B

NEW QUESTION 19

......

Thanks for reading the newest AHM-520 exam dumps! We recommend you to try the PREMIUM Allfreedumps.com AHM-520 dumps in VCE and PDF here: https://www.allfreedumps.com/AHM-520-dumps.html (215 Q&As Dumps)