★ Pass on Your First TRY ★ 100% Money Back Guarantee ★ Realistic Practice Exam Questions

Free Instant Download NEW AHM-520 Exam Dumps (PDF & VCE):

Available on:

https://www.certleader.com/AHM-520-dumps.html

It is more faster and easier to pass the AHIP AHM-520 exam by using Validated AHIP Health Plan Finance and Risk Management questuins and answers. Immediate access to the Rebirth AHM-520 Exam and find the same core area AHM-520 questions with professionally verified answers, then PASS your exam with a high score now.

Free demo questions for AHIP AHM-520 Exam Dumps Below:

NEW QUESTION 1

A primary reason that a financial analyst would measure the Tapestry health plan's return on assets (ROA) is to determine the

- A. Amount of net income per share of Tapestry's common stock

- B. Rate of return on the book value of the stockholders' investment in Tapestry

- C. Proportion of earnings paid out to Tapestry stockholders in the form of cash dividends

- D. Efficiency of Tapestry's management

Answer: D

NEW QUESTION 2

The Newfeld Hospital has contracted with the Azalea Health Plan to provide inpatient services to Azalea's enrolled members. The contract calls for Azalea to provide specific stop-loss coverage to Newfeld once Newfeld's treatment costs reach $20,000 per case and for Newfeld to pay 20% of the next $50,000 of expenses for this case. After Newfeld's treatment costs on a case reach $70,000, Azalea reimburses the hospital for all subsequent treatment costs.

The maximum amount for which Newfeld is at risk for any one Azalea plan member's treatment costs is

- A. $10,000

- B. $14,000

- C. $30,000

- D. $34,000

Answer: C

NEW QUESTION 3

The Norton Health Plan used blended rating to develop a premium rate for the Roswell Company, a large employer group. Norton assigned Roswell a credibility factor of 0.7 (or 70%). Norton calculated Roswell’s manual rate to be $200 and its experience claims cost as $180. Norton’s retention charge is $3. This information indicates that Roswell’s blended rate is:

- A. $186

- B. $189

- C. $194

- D. $197

Answer: B

NEW QUESTION 4

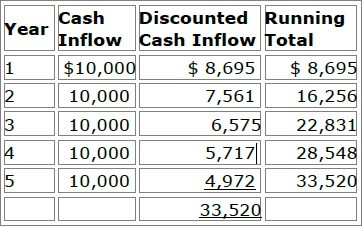

In order to print all of its forms in-house, the Prism health plan is considering the purchase of 10 new printers at a total cost of $30,000. Prism estimates that the proposed printers have a useful life of 5 years. Under its current system, Prism spends $10,000 a year to have forms printed by a local printing company. Assume that Prism selects a 15% discount rate based on its weighted-average costs of capital. The cash inflows for each year, discounted to their present value, are shown in the following chart:

Prism will use both the payback method and the discounted payback methodto analyze the worthiness of this potential capital investment. Prism's decisionrule is to accept all proposed capital projects that have payback periods offour years or less.

After analyzing this information, Prism would accept this proposed capitalproject under

- A. Both the payback method and the discounted payback method

- B. The payback method but not the discounted payback method

- C. The discounted payback method but not the payback method

- D. Neither the payback method nor the discounted payback method

Answer: B

NEW QUESTION 5

The amount of risk for health plan products is dependent on the degree of influence and the relationships that the health plan maintains with its providers. Consider the following types of managed care structures:

✑ Preferred provider organization (PPO)

✑ Group model HMO

✑ Staff model health maintenance organization (HMO)

✑ Traditional health insurance

Of these health plan products, the one that would most likely expose a health plan to the highest risk is the:

- A. preferred provider organization (PPO)

- B. group model HMO

- C. staff model health maintenance organization (HMO)

- D. traditional health insurance

Answer: C

NEW QUESTION 6

With regard to capitation arrangements for hospitals, it can correctly be Back to Top stated that

- A. The most common reimbursement method for hospitals is professional services capitation

- B. Most jurisdictions prohibit hospitals and physicians from joining together to receive global capitations that cover institutional services provided by the hospitals

- C. Ahealth plan typically can capitate a hospital for outpatient laboratory and X-ray services only if the health plan also capitates the hospital for inpatient care

- D. Many hospitals have formed physician hospital organizations (PHOs), hospital systems, or integrated delivery systems (IDSs) that can accept global capitation payments from health plans

Answer: D

NEW QUESTION 7

The Rathbone Company has contracted with the Jarvin Insurance Company to provide healthcare benefits to its employees. Under this contract, Rathbone assumes financial responsibility for paying 80% of its estimated annual claims and for depositing the funds necessary to pay these claims into a bank account. Although Rathbone owns the bank account, Jarvin, acting as Rathbone’s agent, makes the actual claims payments from this account. Claims in excess of Rathbone’s contracted percentage are paid by Jarvin. Rathbone pays to Jarvin a premium for administering the entire plan and bearing the costs of claims in excess of Rathbone’s obligation. This premium is substantially lower than would be charged if Jarvin were providing healthcare coverage under a traditional fully insured group plan. Jarvin is required to pay premium taxesonly on the premiums it receives from Rathbone. This information indicates that the type of alternative funding method used by Rathbone is known as a:

- A. Premium-delay arrangement

- B. Reserve-reduction arrangement

- C. Minimum-premium plan

- D. Retrospective-rating arrangement

Answer: C

NEW QUESTION 8

Most organizations that obtain group healthcare coverage can be classified as one of three types of groups: employer-employee groups, multiple employer groups, and professional associations. One true statement about these types of groups is that

- A. Anti selection risk is higher for both multiple-employer groups and professional associations than it is for an employer-employee group

- B. Private employers typically present a higher underwriting risk to health plans than do public employers

- C. Individual members of a multiple-employer group or a professional association typically are required to obtain healthcare coverage through the group or association

- D. I health plan is prohibited, when evaluating the risks represented by a professional association, from considering the industry experience of the agent or broker that sells a group plan to the association

Answer: A

NEW QUESTION 9

Health plans sometimes use global fees to reimburse providers. Health plans would use this method of provider reimbursement for all of the following reasons EXCEPT that global fees

- A. Eliminate any motivation the providermay have to engage in churning

- B. Transfer some of the risk of overutilization of care from the health plan to the providers

- C. Eliminate the practice of upcoding within specific treatments

- D. Reward providers who deliver cost-effective care

Answer: A

NEW QUESTION 10

The process of converting the present value of a specified amount of money to its future value is known as

- A. Capital budgeting

- B. Compounding

- C. Capital rationing

- D. Discounting

Answer: B

NEW QUESTION 11

Under the alternative funding method used by the Flair Company, Flair assumes financial responsibility for paying claims up to a specified level and deposits the funds necessary to pay these claims into a bank account that belongs to Flair. However, an insurer, which acts as an agent of Flair, makes the actual payment of claims from this account. When claims exceed the specified level, the insurer pays the balance from its own funds. No state premium tax is levied on the amounts that Flair deposits into this bank account.

From the following answer choices, choose the name of the alternative funding method described.

- A. Retrospective-rating arrangement

- B. Premium-delay arrangement

- C. Reserve-reduction arrangement

- D. Minimum-premium plan

Answer: D

NEW QUESTION 12

Dr. Martin Cassini is an obstetrician who is under contract with the Bellerby Health Plan. Bellerby compensates Dr. Cassini for each obstetrical patient he sees in the form of a single amount that covers the costs of prenatal visits, the delivery itself, and post-delivery care . This information indicates that Dr. Cassini is compensated under the provider reimbursement method known as a:

- A. global fee

- B. relative value scale

- C. unbundling

- D. discounted fee-for-service

Answer: A

NEW QUESTION 13

Cascade Hospital has negotiated with the McBee Health Plan a straight per-diem rate of $1,000 per day for medical admissions. One of McBee’s plan members was admitted to Cascade for 10 days. Total billed charges equaled $10,000, of which $2,000 were for noncovered items. This information indicates that, for this admission, the amount that McBee was obligated to reimburse Cascade was:

- A. $0

- B. $8,000

- C. $10,000

- D. $12,000

Answer: C

NEW QUESTION 14

The following statements are about state health coverage reinsurance programs.

- A. The reinsurance offered through these programs is administered on a for-profit basis by the federal government.

- B. The purpose of these programs is to reinsure MCOs and other carriers who offer guaranteed healthcare plans to small employers.

- C. These programs must reinsure only an entire small group, not specific individuals within a group.

- D. Any shortfalls in the pool established by these programs are funded by the state government.

Answer: B

NEW QUESTION 15

The Acorn Health Plan uses a resource-based relative value scale (RBRVS) to help determine the reimbursement amounts that Acorn should make to providers who are compensated under an FFS system. With regard to the advantages and disadvantages to Acorn of using RBRVS, it can correctly be stated that

- A. An advantage of using RBRVS is that it can assist Acorn in developing reimbursement schedules for various types of providers in a comprehensive healthcare plan

- B. An advantage of using RBRVS is that it puts providers who render more medical services than necessary at financial risk for this overutilization

- C. A disadvantage of using RBRVS is that it will be difficult for Acorn to track treatment rates for the health plan's quality and cost management functions

- D. A disadvantage of using RBRVS is that it rewards procedural healthcare services more than cognitive healthcare services

Answer: A

NEW QUESTION 16

Three general strategies that health plans use for controlling types of risk are risk avoidance, risk transfer, and risk acceptance. The following statements are about these strategies. Three of these statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

- A. Generally, the smaller the likely benefits of accepting a risk, and the lower the costs of avoiding that risk, the greater the likelihood that a health plan will elect to avoid the risk.

- B. A health plan is seldom able to transfer any of the risk that utilization rates will be higher than expected and that its cost of providing healthcare will exceed the revenues it receives.

- C. If a risk is a pure risk from the point of view of a health plan, then the health plan most likely will attempt to avoid the risk.

- D. A health plan would most likely transfer some or all of its utilization risk if it pays a provider a rate that is based on the number of plan enrollees that choose the provider as their primary care provider (PCP).

Answer: B

NEW QUESTION 17

The following statements are about a health plan's underwriting of small groups. Select the answer choice containing the correct statement.

- A. Almost all states prohibit health plan s from rejecting a small group because of the nature of the business in which the small business is engaged.

- B. Most states prohibit health plans from setting participation levels as a requirement for coverage, even when coverage is otherwise guaranteed issue.

- C. In underwriting small groups, a health plan's underwriters typically consider both the characteristics of the group members and of the employer.

- D. Generally, a health plan's underwriters require small employers to contribute at least 80% of the cost of the healthcare coverage.

Answer: C

NEW QUESTION 18

Dr. Jacob Winburne is compensated by the Honor Health Plan under an arrangement in which Honor establishes at the beginning of a financial period a fund from which claims approved for payment are paid. At the end of the given period, any funds remaining are paid out to providers. This information indicates that the arrangement between Dr. Winburne and Honor includes a provider incentive known as a:

- A. Risk pool, and any deficit in the fund at the end of the period would be the sole responsibility of Honor

- B. Risk pool, and any deficit in the fund at the end of the period would be paid by both D

- C. Winburne and Honor according to percentages agreed upon at the beginning of the contract period

- D. Withhold, and any deficit in the fund at the end of the period would be the sole responsibility of Honor

- E. Withhold, and any deficit in the fund at the end of the period would be paid by both D

- F. Winburne and Honor according to percentages agreed upon at the beginning of the contract period

Answer: A

NEW QUESTION 19

......

100% Valid and Newest Version AHM-520 Questions & Answers shared by Surepassexam, Get Full Dumps HERE: https://www.surepassexam.com/AHM-520-exam-dumps.html (New 215 Q&As)